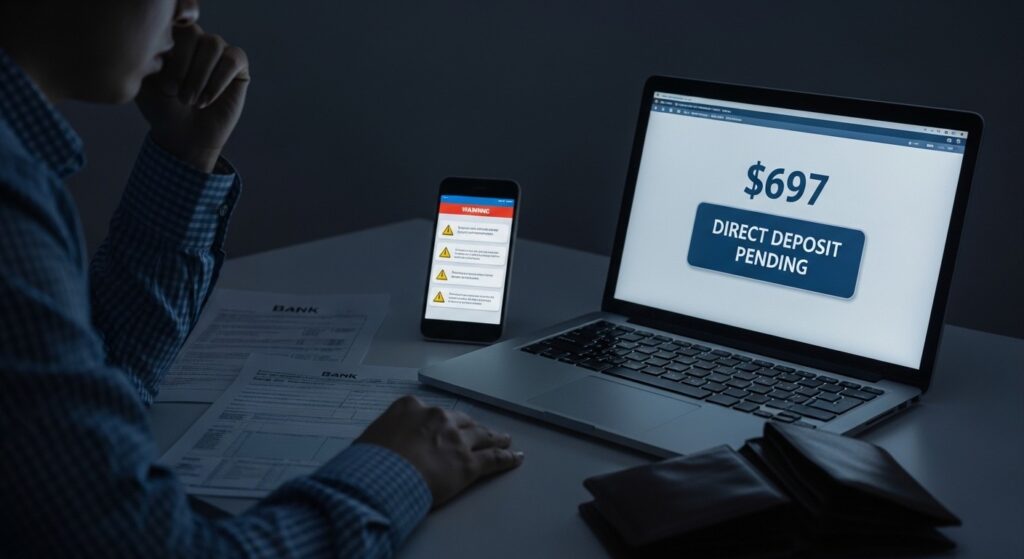

Over the past few months, social media platforms, online forums and messaging apps have been flooded with claims of a rumored $697 direct deposit payment allegedly issued by the US government. These posts often suggest that eligible people will automatically receive funds in their bank accounts without having to apply. As inflation, rising costs of living and financial uncertainty continue to affect millions of families, it is not surprising that news like this spreads quickly and gives hope to those struggling financially.

But when news of financial aid goes viral without any official announcement, it raises serious questions, especially in cases like the rumored $697 direct deposit payment, which has been widely discussed online. Many are unsure whether the payments are genuine, who is eligible for them and which government department is responsible. To truly understand the situation, it is important to separate confirmed information from speculation and look closely at how government payments, including any claims regarding the rumored $697 direct deposit payment, are generally advertised and distributed.

Where Did the Rumor Originate?

The buzz surrounding the rumored $697 direct deposit payment appears to have started with a mix of social media videos, blog posts and screenshots claiming to have inside information. Some of these posts refer to past stimulus checks or state-level aid programs and assume that similar payments are coming again. Others use vague language, avoiding official sources while still sounding good enough to be shared thousands of times.

In many cases, these rumors gain traction because they mix real financial stress with partial truth. Governments have issued bailout payments in the past, and this history makes people more likely to believe new claims. Unfortunately, this environment also allows misinformation to spread easily, especially when people are desperate for financial relief.

How Government Direct Deposit Payments Actually Work

To assess whether the rumored $697 direct deposit payment is real, it helps to understand how official payments are handled in general. Government agencies such as the IRS or the Social Security Administration follow strict procedures. Any new payment programs are usually announced through official press releases, public websites and verified media before the money is sent.

Payments are not issued randomly, nor are they deposited in secret without clear eligibility rules. In most cases, legislation must be passed or the budget approved before funds can be released. The process includes transparency, documentation and public communication. When none of these signs are present, the viral claim becomes less likely to reflect an actual government program.

Latest Updates From Official Sources

As of the latest information available, there has been no confirmed announcement from federal agencies regarding the rumored $697 direct deposit payment. Neither the IRS nor the U.S. Treasury has issued statements confirming nationwide payment of this amount. Official government portals that usually provide updates on financial assistance programs do not list any such initiatives.

The lack of confirmation does not automatically mean that the financial aid programs will never happen, but it does suggest that the specific claim circulating online is unverified. Government responses to similar rumors in the past have often included warnings to trust only official channels and avoid relying on unverified social media posts.

Eligibility Rules Being Claimed Online

Many of the posts discussing the rumored $697 direct deposit payment include their own eligibility criteria. Some claim the payment is for low-income families, others say it is for pensioners, while some suggest it applies to all taxpayers. These inconsistencies are a big red flag because real programs always have clearly defined rules.

In fact, eligibility for government aid depends on factors such as income level, tax filing status, age, or enrollment in specific benefit programs, a pattern often seen in financial relief issued during periods of economic stress. Without a single, consistent set of criteria included in IRS direct deposit updates, published or verified by an official authority, it becomes difficult to trust claims circulating online. This confusion is often an indication that the information is fiction rather than fact and should be seen as part of ongoing government stimulus rumors rather than a confirmed policy.

Common Supportive Claims and Keywords Explained

Supporters of the rumor often link it to financial aid payments, suggesting that the government is responding to inflation and fiscal pressures. Others link it to the IRS direct deposit update, which means tax-related systems are already ready to send the money. The third frequently mentioned idea is rumors of government stimulus, based on memories of past stimulus checks issued during the financial crisis.

While these supporting keywords seem reliable, none of them alone confirm new payments. Financial assistance programs require formal approval, IRS systems do not activate payments without authorization, and hearing is not the same as law. Highlighting these connections can make the claims seem more realistic, but they still do not replace official confirmation.

Claim vs Verified Information

| Aspect | Online Claims | Verified Reality |

| Payment Amount | $697 guaranteed | No official confirmation |

| Payment Method | Automatic direct deposit | No agency announcement |

| Eligibility | Varies by source | No published criteria |

| Issuing Authority | IRS or Treasury (claimed) | Not confirmed |

| Application Required | No | No verified program exists |

This comparison clearly shows the gap between what is being claimed online and what has actually been verified through official sources.

Government Response to Similar Past Rumours

When similar claims have gone viral in the past, government agencies have responded by clearing up the misinformation. In many cases, officials emphasized that legitimate payments are always publicly declared and never required to be confidential. He also warned people to avoid sharing personal information based on unconfirmed promises of payment.

While there has been no specific press conference to address the rumor of the $697 direct deposit payment, past reactions suggest that officials prefer to correct misinformation through official updates and website announcements. This pattern supports the idea that silence from official channels usually means that a claim is not legitimate.

Risk of Believing Unverified Payment Claims

Believing unverified payments like the rumored $697 direct deposit payment can have real consequences. Some scammers take advantage of viral rumors to trick people into providing bank details, social security numbers or login information. These scams often promise to “expedite” payment delivery or “verify eligibility,” which are classic warning signs.

Aside from fraud, misinformation can also cause emotional distress. People may plan their finances around money that never comes, leading to disappointment or financial stress. That’s why it’s important to verify information before acting on it, especially when it comes to personal finances.

How to Verify Financial Assistance Information

Always trust official government websites and trusted news organizations for your safety. Agencies such as the IRS, Treasury Department or Social Security Administration provide accurate updates when new programs are launched. If a payment is genuine, it will be widely reported by reputable sources.

It’s also wise to be wary of posts that use urgent language or push you to act quickly. Real public programs take time for people to understand the eligibility and application processes. Any claim that calls for immediate action should be treated with skepticism.

Why These Rumors Keep Appearing

Persistent claims such as the rumored $697 direct deposit payment reflect macroeconomic concerns. Rising prices, job insecurity and uncertainty about the future make people more receptive to promising news. Social media algorithms also play a role in amplifying content that elicits strong emotional reactions regardless of accuracy.

Understanding this context helps explain why such rumors spread so quickly. This is not just about misinformation, but also about genuine financial fear and desire for relief. Acknowledging this may encourage a more cautious and critical approach to viral claims.

Conclusion

Based on current evidence, the rumored $697 direct deposit payment does not appear to be a confirmed government program. There is no official announcement, no confirmed eligibility criteria and no documented payment program. Although financial assistance programs may exist or may be offered in the future, this specific claim remains unconfirmed.

Staying informed through reliable sources and avoiding unverified claims on social media is the best way to protect yourself. If new aid programs are approved, they will be announced in a clear and transparent manner. Until then, it’s safest to treat this rumor with caution and only rely on official updates.